Latest News

“Petrogas awards decommissioning contract to Heerema Marine Contractors for platform removal in Block Q1, Offshore Netherlands”

Petrogas E&P Netherlands B.V. (a part of Petrogas E&P LLC, head quartered in Muscat, Oman) has awarded Heerema Marine Contractors an integrated engineering, preparation, removal, and disposal (EPRD) decommissioning contract for multiple North Sea platforms.

The work involves removing the Haven, Hoorn, Helm, and Helder platforms from Block Q1 of the Dutch sector in the Southern North Sea. The execution of the offshore removals will take place over several years.

Over the last 40 years of production, the platforms have been important contributors to the Dutch oil and gas industry, with the Helm platform being the first to produce oil on the Dutch continental shelf for the Dutch market, starting production in October 1982. Their removal is the final stage in a key part of the Netherlands` energy history.

Usama Al Barwani, CEO of Petrogas E&P LLC, said: ‘One of our core values in Petrogas is to “Give back” to Society, Environment, and our stakeholders. This value is imbibed in our commitment towards ESG responsibilities for our Netherlands business, throughout the lifecycle of our assets. I look forward to a fruitful and sustainable partnership with Heerema for the safe and efficient removal of these platforms.’

Sen Kingsuk, CCO and VP-Europe of Petrogas E&P LLC, added: “Petrogas’ foray into offshore operations in the Netherlands provided a great opportunity for us to grow and create value. At the same time, we also took on the responsibility and commitment to safely decommission these mature assets when they reached the end of their productive lives. I am so happy and proud to see us take this step through our partnership with Heerema, to fulfill our responsibility and commitment to restore mother nature.”

Koos-Jan van Brouwershaven, Heerema`s CEO, said `We are proud to be Petrogas E&P Netherlands` chosen contractor for this significant decommissioning project. Our team is looking forward to working closely with Petrogas to prepare and execute the safe and sustainable decommissioning of these platforms.`

‘Heerema has installed the majority of North Sea platforms, and we believe in the circularity of removing these structures, leaving the sea as we found it. This action aligns with our own sustainable and circular ambitions to reuse and recycle wherever possible.’

Nick Dancer, Petrogas E&P Netherlands’ General Manager said ‘We are proud to have reached the 40th year of production with these assets, but the time has come to remove the platforms. This contract demonstrates Petrogas’ commitment to the safe and timely removal of our facilities and we are very pleased to have signed this contract with Heerema, whom we believe are the ideal partner for this project with their commitment to sustainability and circularity.’

“PETROGAS RECEIVES ISO 14001:2004 AND OHSAS 18001:2007 CERTIFICATIONS”

Petrogas E&P, the Exploration & Production arm of MB Holding Group of Companies recently received two international certifications - the ISO 14001:2004 - Environment Management System and the OHSAS 18001:2007 Occupational Health and Safety Management System. The company is now internationally recognized for its high level of standards in Environment Management Systems and HSE in alignment to ISO 14001:2004 & OHSAS 18001:2007 and monitored with strict parameters that are used globally. As one of the leading Exploration & Production companies in the Sultanate, Petrogas conducted comprehensive audits that covered every aspect of its business in the Muscat Head Office as well as field operations in Rima to pursue these certifications.

Dr. Mohammed Al Barwani, Chairman – MB Holding commended team Petrogas on this achievement. He said “We strive to be on par, if not better than the highest global standards in every facet of our operations. It helps us demonstrate our serious commitment towards the environment we operate in and the health and safety of our employees as well as the community at large. Congratulations to the management and team on this milestone.”

Some benefits of these certifications include awareness and protection of the environment, reduction of accidents and incidences, staying abreast of relevant legislations and reduce the likelihood of prosecution and fines, standardization of HSE management systems keeping in mind international procedures and rules.

Usama Al Barwani, CEO – Petrogas, said, “The ISO 14001:2004 & OHSAS 18001:2007 certifications are globally recognized symbols of our organization`s ongoing commitment to excellence, sustainability and reliability. Organizations of all kinds are increasingly concerned by achieving and demonstrating sound Environmental and Occupational Health and Safety performance to their shareholders, employees, clients and other stakeholders. This is possible by managing the hazards and improving the beneficial effects of their activities, products and services. We are delighted that Petrogas has received these certifications and this further reaffirms our commitment to stringent legislations and measures on these aspects.”

The Corporate QHSE Manager, Dr. Ghudayyer Al Waheibi, also added in his speech: “Petrogas as a certified company in all its operations continues to hold a competitive edge by upgrading its standards to the level of world class oil producers.”

Established in 1999, Petrogas E&P is the holding company for MB Group’s Exploration and Production (E&P) assets in Oman, Egypt and The Netherlands. Petrogas E&P subsidiaries are engaged in the full range of Oil & Gas activities from exploration through appraisal, development and production.

Petrogas of MB Group wins “Best Nationalization initiative in the private sector”

On the 31st of October, in Abu Dhabi, Petrogas E&P of MB Group was recognized by ‘GCC GOV HR Awards’ for its efforts in Human Resources & People performance. Petrogas won an award for ‘Best Nationalization initiative in the private sector`. The organization was selected from amongst some of the best & most prestigious companies operating in the GCC.

The ‘GCC GOV Awards’ Aims to recognize, promote & reward professionalism and outstanding achievements of governments, business organizations, and people who have raised the bench mark of people performance across the region. The Petrogas HR team members are humbled and honored that their efforts have been recognized and are further motivated to continue to work toward people performance and development of young Omanis.

Yasser Al Mughairi, Chief Human Resources Officer stated, " winning an award in the category of Nationalization is a testament to His Majesty Sultan Qaboos bin Said Al Said, vision & personal dedication to empowering the Omani people. Today, Petrogas E&P and MB Group of companies have tirelessly worked towards His Majesty`s vision in employing, training and empowering the Omani work force.

Petrogas E&P was also nominated for “Innovation in employee engagements in the private sector." Although, there was high competition in this category, Petrogas E&P managed to be shortlisted by GCC GOV HR panel.

In Petrogas and MB Group companies, we believe in Omanization and the operational, economic and social value it brings. Our future plans embed stretched targets for empowering and developing Omanis, supporting ICV and fostering Oman’s economy.

MB Group Introduces Sharifa Al HarthyHR Award of Excellence

Award Dedicated to The Group’s Vice Chairperson to Acknowledge Her Significant Contributions Petrogas E&P LLC HR Team Proud Winner of Sharifa Al Harthy HR Award of Excellence 2017

MB Holding Group has introduced Sharifa Al Harthy HR Award of Excellence;that is granted to winner of the newly launched HR Standards of Excellence scheme. TheStandardswill form a benchmark for HRFunctional Excellence within MB Group.Dedicating this Award to the Vice Chairpersonhas come in recognition ofher significantcontributions to HR profession and the business community in general. In addition, this award is an appreciation of her long served career as the Head of HR for MB Group, as well as her continuous support to HR fraternity within the Group and beyond.Badran Al Hinai, the Group HR Manager has stated “HR Standards of Excellence scheme will play a major role inpeople management in the business.We are immensely honored as a profession that Mrs. Sharifa Al Harthy has accepted to sponsor the HR Award of Excellence”.

This scheme will be used for various HR audits and benchmarksto support the goal of standardization and the 1-HR concept locally & globally. Moreover,the scheme encourages different stakeholders to adopt best HR practices and elevates the overall functional professionalism and excellence in the MB Group.

Each MB Group company HR has been evaluated against the MB HR Excellence standards. It is not a competition between companies, but a benchmark against the standards. First step in the process was to carry out self-assessment by HR departments, followed by business verification by business leaders.Final evaluation and verification weredone initially by the Internal Audit department with independent HR representation, followed by independent senior management panel.

The recognition ceremony was held on 18thof September during the HR Town hall meeting.Petrogas E&P LLC HR team was the best performing MB Group Company against the standards in 2017 followed by the runner up MBPS Well Services department and MBPS Production Services department in the third place. The proud winner, Petrogas E&P LLC HR team,received their trophy from Mrs.Sharifa Al Harthy in a ceremony attended by theGroup HR managers and professionals.

“Petrogas spreads its wings to Europe - enters the Netherlands by acquiring Chevron’s oil & gas entities in the Netherlands.”

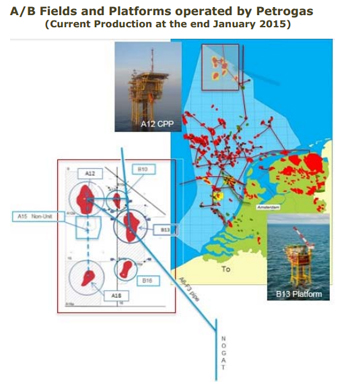

In 2014, Petrogas purchased all the outstanding sharesof Chevron Exploration and Production Netherlands B.V. (CEPN), including its subsidiary Chevron Transportation B.V. (CT). The Dutch assets A/B and P/Q are now held under Petrogas Exploration and Production Netherlands.

The purchase includes operating working interests in 11 blocks in the Dutch sector of the North Sea. This includes seven blocks, with working interests ranging from 23.5% to 34.1%, which make up the A/B Gas Project. Also included are working interests ranging from 46.7% to 80% in three blocks that contain other producing fields and a 100% working interest in the P2 exploration block.

PEPN currently employs 189 personnel including 127 employees and 62 regular contractors in offshore and onshore positions in the Netherlands.

PEPN owns and operates interests in the A and B Blocks (including the recently acquired A15 and B17 licences). In 2005, the company and its partners were granted production licenses enabling the development of the A/B shallow gas fields in the Dutch North Sea. A central processing platform and an export pipeline were installed in Block A12 in 2007. First gas was achieved in December 2007. Since then the B13 (unmanned) production platformhas been commissioned and brought online in December 2011.

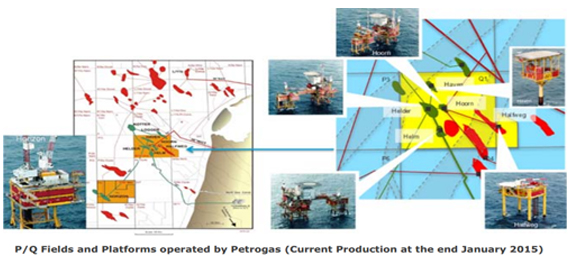

PEPN also operates and owns the P/Q Oil Area with existing production from five fields viz: Q1 Block (including the Helm, Helder, Hoorn and Haven fields), the P9 Horizon field (straddling P9a and P9c), the Halfweg field (straddling Q1 and Q2c) and the P02 exploration block.

PEPN has been active in the Netherlands since the mid-1960s and producing Oil since 1982 (then operated by Unocal). First production from the Helm and Helder platforms in block Q1 took place that year. This was celebrated in 2012, marking a significant milestone as 30 years of offshore oil production. Currently there are 6 platforms in the P/Q fields operated by Petrogas.

In 2014, total average daily production was in the tuneof 2,400 barrels of crude oil (net ~1950 bopd) and about 117 million cubic feet of natural gas (net ~40 mmscfd). The barrel oil equivalent daily production net to the company was in the tune of 8,800 boepd.

“Petrogas acquires swedish company’s north sea assets ”

As part of it’s plan to grow its resource base in North West Europe, Petrogas has signed a Sales Purchase Agreement (SPA) with PA Resources AB to acquire some of its subsidiaries holding a number of exploration and potential developmental interests in Denmark, The Netherlands, UK and Germany. The transaction is subject to fulfillment of a number of conditions including regulatory approvals, and is expected to close during the first quarter of 2016.